With more than 30 years of investment banking experience in the senior living industry, Dan Hermann, President, CEO and Head of Investment Banking at Ziegler (www.ziegler.com), understands the longevity economy like few others. He knows the ins and outs, the barriers to entry and the key challenges providers face. He also knows the immense potential the $7.6 trillion economic sector yields for both entrepreneurs and investors.

Ziegler has built an extensive network of alliances that keeps the national boutique investment bank dialed into promising emerging companies in the longevity space, scouring the showroom floors at major tech conferences and trade shows like CES and HIMSS for potential investment partners. The firm manages the Ziegler Link·Age Funds, LP, a joint venture that, to date, has invested in 24 companies providing solutions along the aging services continuum.

“At Ziegler, we’re interacting with care providers in the health system and senior living settings, as well as home care, on a daily, hourly and minute-to-minute basis,” he said. “We’re partnering with the companies that emerge with groundbreaking solutions that then grow, raise capital and are often enticed to merge or sell to the bigger strategic players. We’re in the flow and more integrated than just about any investment bank.”

Read below for more insights from one of the key investment leaders in the longevity economy.

How important is continued innovation in the senior living and longevity arena?

We’re in a capitalistic system where disruptive innovation gets rewarded and attracts capital – the health care system is no different. It’s approximately 20% of the economy…is immensely expensive and growing at a rate two to three times inflation.

So, it’s ripe for innovation. This can come from continued value-added services that provide and extend care. There are tech-enabled services that will save money through acceleration, elimination of waste and so forth. Then there’s new disruption that leads to broadened areas of care and experience – an incremental new element like virtual reality. It’s becoming beyond novel for the senior living marketplace…it actually helps reduce loneliness and create emotional engagement, giving seniors experiences that they couldn’t accomplish on their own. Companies like Embodied Labs are booming with virtual reality right now.

What do you look for when investing in a company?

Ideally, they’ll be adding clear, incremental new value, usually focused on at least one point solution. PayActiv, for example, improves the process of getting cash to employees instead of them getting (high interest rate) credit cards or payday loans. It’s very affordable, and we knew our senior living clients would pursue it.

We look for a long enough runway, with limited competition, to give a company time to grow. And then we look for quality management teams that are led by passionate leaders who understand how to grow a company with third-party venture capital and private equity.

We also look for partner investors that bring strategic input to table.

What advice do you have for entrepreneurs in the aging/longevity space that are seeking funding?

It’s rare that the companies we invest in need regulatory approval, so that makes our area much easier.

Prior to looking for your first institutional capital, you want to have your product refined, be in market with a start of clients beyond the pilot stage and have an understanding of how you plan to grow the company through incremental new sales within the space. The bigger you can build the real client base, the easier it becomes because then it’s about scaling.

And be aware of the competitive environment. While you’re working on your solution, don’t be naive. There might be a company in Boston and a company in California working on the same thing, trying to solve the same problem.

What’s the benefit for entrepreneurs and investors in attending events like the Silicon Valley Boomer Venture Summit?

When done well, it’s a great opportunity to bring together like-minded organizations that have the same interests.

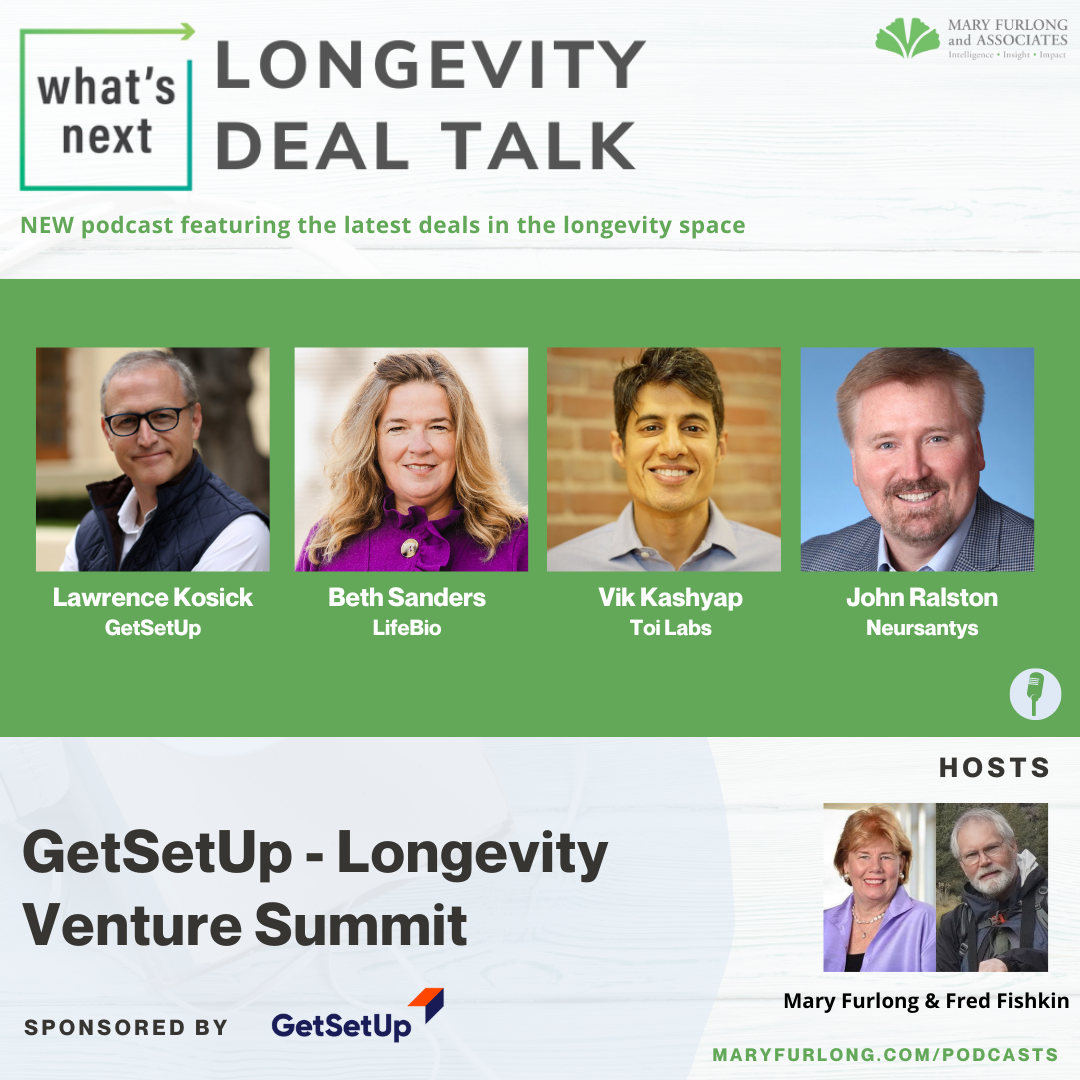

Mary (Furlong) has a good understanding of entrepreneurs that are emerging in the aging services space. The companies that participate in her events typically have a very legitimate point solution or new service that adds unique value to the sector. She also does a great job maintaining relationships with companies that previously participated and have grown and can provide guidance to others.

It’s a good matchmaking effort that always leads to an engaging conference.

0 Comments